Monetary Policy: RBI keeps repo rate unchanged at 6.5%

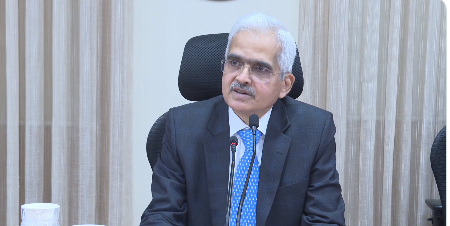

RBI's governor Shaktikanta Das said that monetary policy committee decided to keep repo rate unchanged at 6.5 per cent.

The Reserve Bank of India (RBI) announced its monetary policy committee meeting decision today and kept the repo rate unchanged at 6.5%, giving a breather one more time to homebuyers and prospective loan borrowers who waited for this announcement cautiously.

In the past since May 2022, the RBI increased the repo rate by 250 basis points leading to costlier home, auto, and other types of loans on floating rates. The central bank ensured that the inflation remained under its comfort zone and was able to achieve some success in keeping inflation under check. However, the floods and weaker monsoon rains in many parts of the country have raised concerns and hinted at upward corrections in borrowing costs.

Post Monetary Policy Press Conference by Shri Shaktikanta Das, RBI Governor- August 10, 2023 https://t.co/a6SE9WdApa

— ReserveBankOfIndia (@RBI) August 10, 2023

Today’s decision gives hope to home loan borrowers who delayed their purchasing decision due to the rising cost of housing prices and home loans. This is the time when existing loan borrowers can partially prepay their loans to reduce some financial burdens that have come due to increased interest rates in the past.

Rising home loan interest rates have led both existing and new buyers to worry about their future financial liabilities and create an environment of cautiousness before taking big financial decisions like purchasing a house.

A home loan is a long-term debt where you pay for 10-20 years without delay and default on your loans. The rising interest rate is a concern of many borrowers who are already facing the heat owing to rising monthly bills on grocery, medical, education, and other requirements.

Let’s understand in detail the impact of the repo rate in India.

The repo rate is the interest rate at which the Reserve Bank of India (RBI) lends money to commercial banks for short periods, usually around two weeks. It is a key monetary policy tool used by the RBI to control inflation, stimulate economic growth, and manage liquidity in the financial system.

The repo rate plays a significant role in influencing various interest rates in the economy, including those for home loans. Here’s how it impacts home loans:

Borrowing Cost

The repo rate directly affects the cost of funds for banks. When the RBI increases the repo rate, borrowing money from the RBI becomes more expensive for banks. In turn, banks might increase their lending rates, including the interest rates on home loans, to maintain their profit margins. This can lead to higher monthly installment payments for home loan borrowers.

EMIs May Go Up

When the repo rate increases, banks tend to raise their lending rates, which can result in higher EMIs for existing and new home loan borrowers. On the other hand, when the repo rate decreases, banks may reduce their lending rates, potentially leading to lower EMIs.

Demand for Home Loans

Higher interest rates can deter potential home buyers from taking out loans, as the cost of borrowing becomes more expensive. This can impact the overall demand for housing and real estate. Conversely, lower interest rates can encourage more people to take out home loans, boosting the real estate sector.

Economic Impact

If inflation is high, the RBI may increase the repo rate to curb spending and control prices. This can have a broader impact on the overall economic environment, including consumer sentiment, investment, and spending patterns, which indirectly affect the real estate market.

It’s important to note that the impact of changes in the repo rate on home loans might not be immediate and can vary based on several factors, including the stance of individual banks, the prevailing economic conditions, and global market trends. Home loan borrowers must stay updated with the monetary policy decisions and the potential impact on their old and new loans.