RBI’s decision on repo rate at 10 AM

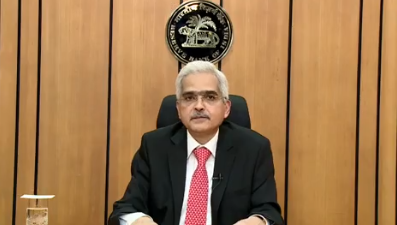

RBI's governor Shaktikant das

The Reserve Bank of India (RBI) is likely to keep the repo rate unchanged at 6.5% in its monetary policy meeting on August 10, 2023. This is because inflation has remained under control in recent months, and the economy is showing signs of recovery. Another hike could dampen growth as it may not only hurt home buyers’ sentiments owing to higher interest rates but also affect the real estate industry.

Almost all industries are cautious as a rate hike can’t be ruled out for longer since food inflation may lead to higher inflation levels in the country. RBI was able to bring back the inflation to its comfort levels but floods across India and other external factors have once again put the pressure back on the central bank.

Here are some of the factors that are likely to weigh on the RBI’s decision to keep the repo rate unchanged:

- Inflation: Inflation has remained under control in recent months

- Economic growth: The Indian economy is showing signs of recovery. This growth is being supported by strong government spending and private investment.

- External environment: The external environment is also favorable for the Indian economy.

On August 10, the RBI will announce its decision at 10 AM on the repo rate policy. According to experts across sectors, it is expected that RBI will keep the rate unchanged in order to support economic growth.

Coming up:

— ReserveBankOfIndia (@RBI) August 9, 2023

Monetary Policy statement by #RBI Governor @DasShaktikanta at 10:00 am on August 10, 2023.

Watch live at: https://t.co/LpBbmepwub

Post policy press conference telecast at 12:00 pm on the same day. https://t.co/nAuP60QQVB#rbipolicy #rbigovernor #rbitoday… pic.twitter.com/bDd4dDBs4T

Impact of Repo Rate

The impact of the repo rate in India is significant and far-reaching, influencing various aspects of the economy:

Borrowing Costs for Banks: When the RBI lowers the repo rate, borrowing money from the central bank becomes cheaper for commercial banks. This prompts banks to borrow more funds, which can then be lent to businesses and individuals at lower interest rates. This reduction in lending rates can encourage borrowing and investment, thus stimulating economic activity.

Interest Rates for Consumers: Lower repo rates tend to lead to lower lending rates for consumers. Home loans, auto loans, personal loans, and other forms of credit become more affordable, which can incentivize people to make big-ticket purchases, leading to increased consumer spending.

Investment and Business Activity: A lower repo rate can lead to reduced borrowing costs for businesses as well. Cheaper loans can incentivize businesses to invest in expansion, modernization, and new projects. This, in turn, can boost economic growth and job creation.

Savings and Fixed Deposits: On the flip side, lower interest rates can affect savers and retirees who rely on fixed deposits and other fixed-income investments for income. With lower interest rates, the returns on such investments might be lower, prompting individuals to explore other investment avenues.

Inflation Control: One of the primary reasons for using the repo rate is to control inflation. If inflation is rising beyond the RBI’s target, it might raise the repo rate to make borrowing more expensive, thus reducing spending and curbing demand. This, in turn, can help bring down inflation.

Foreign Exchange Rates: Changes in the repo rate can influence the foreign exchange market. A higher repo rate might attract foreign investors looking for higher returns on their investments, leading to an influx of foreign capital. This can potentially strengthen the country’s currency.

Asset Prices: Lower interest rates can lead to increased demand for assets like real estate and stocks, driving up their prices. This can be advantageous for asset owners but might make it challenging for first-time buyers to enter the market.

Government Debt: The repo rate can also influence the yield on government bonds. When the RBI increases the repo rate, it becomes more expensive for the government to borrow money, potentially affecting its ability to finance its programs and projects.

Consumer Sentiment: Changes in the repo rate can impact consumer sentiment. If people perceive that interest rates will remain low, they might be more willing to spend. Conversely, if they expect rates to rise, they might hold back on spending.

The repo rate is a powerful tool that the RBI uses to shape the economy. By adjusting this rate, the RBI can influence borrowing costs, inflation, investments, savings, and overall economic activity. It’s a delicate balance that requires careful consideration of various economic factors to achieve the desired outcomes of growth, stability, and inflation control.